About Fund

SEBI Category II Alternative Investment Fund (AIF)

SEBI Registration No. : IN/AIF2/22-23/1178

Project Type

Residential & Commercial Real Estate Project

Stage of Investee Projects

Mid-last Mile Investments & Discounted buyouts in Stressed Assets

Underlying Instrument

Senior Secured Debt, Subordinated Debt, Mezzanine Debt & Quasi Equity Instruments

Focus

Indian Real Estate Focused

Investment Manager (IM)

Nisus BCD Advisors LLP

About Fund

| Target Size | INR 1500 Cr+ Green shoes option of INR 200 Cr |

| Term | The Term of the Fund shall be a period of 7 (seven) years and 6 (six) months from the First Closing (extendable by 2 years) |

| Minimum Investment | INR. 1 Cr. or any minimum amount as provided under the Regulations |

| First Closing | Not later than 12 (twelve) months from the date on which SEBI takes this Memorandum on record, subject to receipt of aggregate Capital Commitments of INR 20 Cr (Indian Rupees Twenty Crores) or such shorter period as determined by the Investment Manager in accordance with the Regulations. |

| Final Closing | Within 30 (Thirty) months from the First Closing |

| Drawdown Notice Period | 15 (Fifteen) Business days |

| Sponsor and Anchor Investor Commitment | 2.5% of the Corpus or 5 Crores, whichever is lower Sponsors: Nisus Finance Services Co Limited BCD Bangalore LLP |

| Hurdle Rate of Interest | 12% (pre-Tax) pa |

| Target Gross IRR | 20-21% |

About Fund

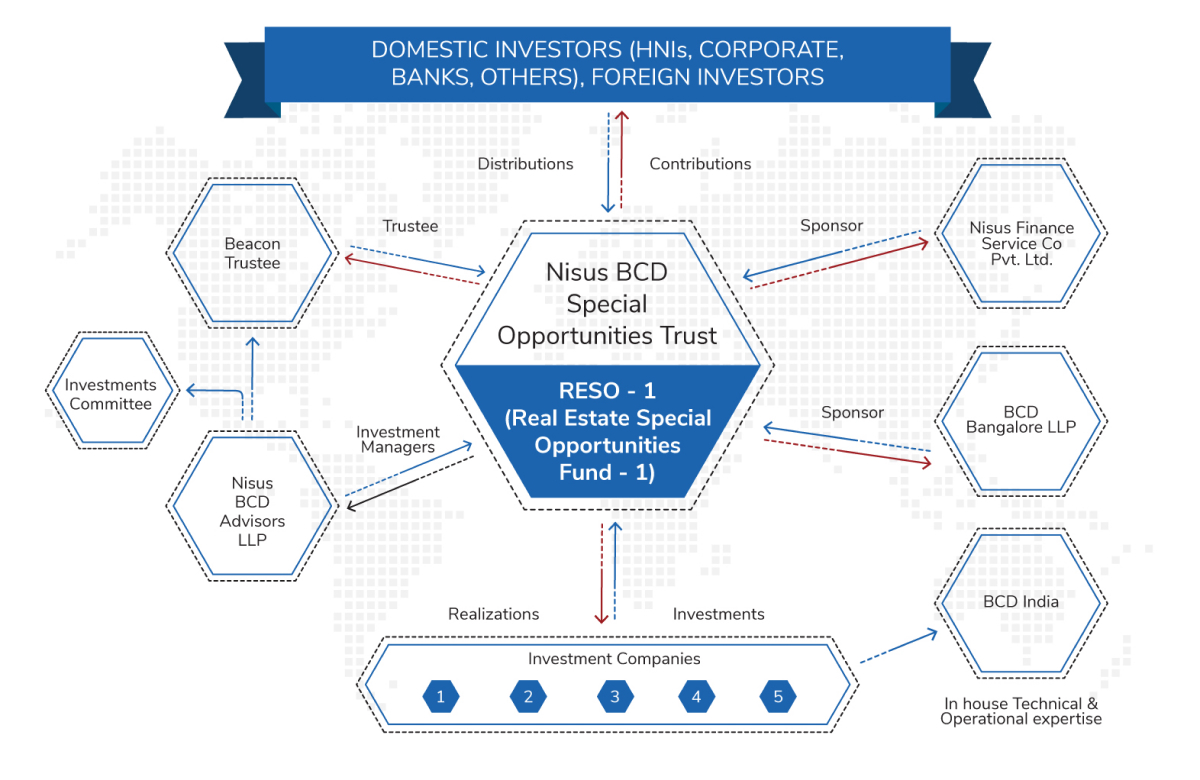

Nisus BCD Advisors (Investment Manager)

Investment Manager, Sponsor

Nisus BCD Advisors LLP is a collaboration between NiFCO and BCD India targeting special situation Real Assets with high margin of safety providing in-house technical, financial, and operational support to investee companies. The collaboration has high capital synergies with expertise in asset management and investment management.

Nisus Finance

Anchor Investor, IM Partner

Nisus finance specializes in urban infrastructure finance and private capital transactions. Founded in 2014, the group fosters strong relationships across investors, funds, domestic and global LPs (Limited Partners), asset owners, financial institutions, family offices, and partner consultants.The management team has over 100+ years of relevant experience across urban infrastructure transactions worth over INR 200 bn either as principals, fund managers or providers of corporate urban infrastructure services.

BCD Group

Anchor Investor, IM Partner, Sponsor

With 70 million sq. ft. built and 100+ projects worth ₹2,000 Cr., BCD Group is a leader in real estate, delivering iconic landmarks across India and abroad. Backed by India’s largest labor force, it offers end-to-end solutions in design, approvals, construction, and more.Led by Mr. Angad Singh Bedi, the third-generation company is shaping a better India and making a global impact.

About Fund

About Fund

SANDEEP BAID

Advisor at DSP Investment Pvt. Ltd.

- Previously

- Member Founding Team, Managing Director & Head Credit at Indostar Capital Finance Ltd.

- MD & Head of Debt Capital Markets - Bank of America & DSP Merrill Lynch

- Associate Director -Rabo India Finance

- More than 20 years of experience in financial services, lending and investments

- PGDBM-IIM Calcutta

- He has led lending transactions of more than INR 35,000 cr over last 15 years without any losses or NPAs

SUNIL AGARWAL

Founder - Black Olive Ventures ("BOV"), Co-Founder - South Asian Real Estate (SARE), FDI RE Fund Advisory board Member- Sotheby's India

- Held senior positions - ICICI Ventures, HSBC, DS Group, Colliers International, Chesterton Meghraj

- Specialist in Turnaround Management, Start-up's

- Professional for the Year 2010" in "Realty Plus" magazine

- IC Member - Mirae Asset Management's India Real Estate fund

- Honorary Doctorate in Real Estate

Heetesh Veera

- CA and Commerce Graduate from Mumbai University. He secured the All India 49TH Rank in his final CA Exam.

- He has post qualification experience of around 40 years which includes working with Manufacturing Industry , ICICI Bank and Partner with consulting firm Ernst & Young (EY) for over 27 years .

- During his long career he has been advising Multinationals and large Indian Groups on various areas of Indirect taxes, Business structuring, Helping companies to undertake due diligences for takeovers and mergers , demergers and acquisitions. He was instrumental in bringing in requisite changes in the business operations and processes at the time of GST implementation for many of his large clients in 2017 and advising them thereafter on business operations and GST implications .

- He has been part of 2 Public Charitable Trusts as Trustee for last 25 years which are actively involved in Free / subsidised Medical help/ facilities to poor and needy people in the backward areas of Kutch District ( Shree Bidada Sarvodaya Trust ) in Gujarat and also in Mumbai (Maru Hospital, Parel).

About Fund

AMIT GOENKA (CEO)

Founder, MD & CEO of Nisus Finance Group

- Founder MD Essel Finance. Was National Director-Knight Frank

- Worked in senior capacities at Ernst & Young and Aditya Birla Group.

- Led transactions of over INR 21,000 Crores

- Managed 2 AIF, 1 PMS and 1 FDI fund for India RE

- Renowned expert -Indian real estate financing

- BE, MBA, MRICS, CFM

ANGAD BEDI (SPONSOR)

MD of BCD Group - India and Global, Chartered Accountant by profession

- Worked in senior capacities at PWC. KPMG

- Advised foreign listed companies on taxation nuances of cross border mergers and acquisition

- Advised promoters of listed Indian companies and billion-dollar groups in restructuring of their holdings and consolidate shareholding and control.

AVADHOOT SARWATE (CIO)

- Chartered Accountant & CFA professional, with decadal experience in senior capactities across Real Estate & Infrastructural funding

- Working with the investment committee for making investment decision and monitoring project performance and facilitating smooth exits of real estate projects

- Raisied term loans, working capital, equity, structured finance at the group level and investee companies i.e., real estate developers

- Worked in senior capacities at Brick Eagle-Affordable Housing Platform, GMR Group