About Fund

The investment objective of the fund is to achieve superior, consistent, risk-adjusted returns by primarily making opportunistic medium term debt investments in late stage mid-income housing projects

SEBI Registered Category II Alternative Investment Fund (AIF)

SEBI Registration No. : IN/AIF2/18-19/0647

Project Type

Residential Plotting & Urban Infrastructure Projects

Stage of Investee Projects

Brownfield (Advanced Stage Projects)

Underlying Instrument

Senior Secured NCD

Focus

Indian Real Estate Focused

Investment Manager (IM)

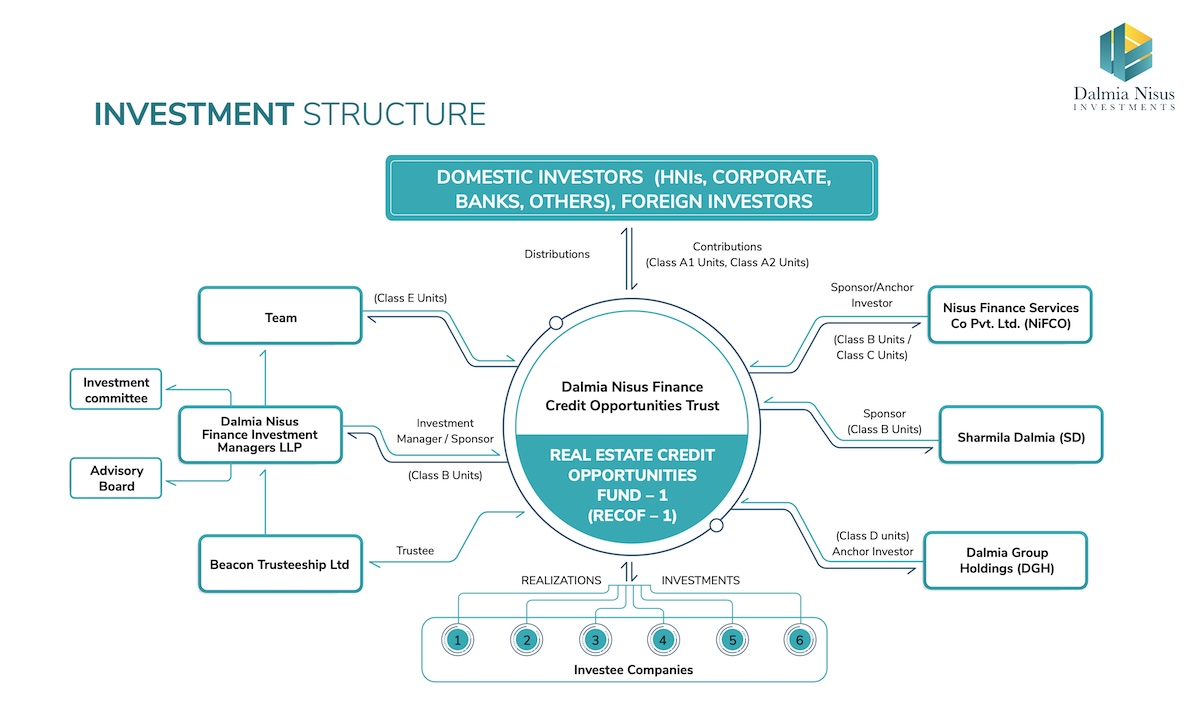

Dalmia Nisus Finance Investment Managers LLP

About Fund

| Target Size | INR 500 Cr. (Including INR 200 Cr. Green Shoe option) |

| Term | 4 (four) years from the date of Final Closing (extendable by 2years) |

| Minimum Investment | INR 1 Cr. or any minimum amount as provided under the Regulations |

| First Closing | 12 (twelve) months from the date of registration from SEBI as Category II AIF |

| Final Closing | 30 (thirty) months from the First Closing |

| Commitment Period | 24 (twenty four) months from the Final Closing (extendable by 1 year) |

| Drawdown Notice Period | 15 (Fifteen) Business days |

| Sponsor and Anchor Investor Commitment | 15% of aggregated capital commitment |

| Anchor Investors | Nisus Finance Services Co Pvt.Ltd (NiFCO), Dalmia Group Holdings (DGH) |

| Hurdle Rate of Interest | 12% IRR (Pre Tax) |

| Target Gross IRR | 20-21% |

About Fund

About Fund

About Fund

Mr. Sunil Agarwal

Mr. Aggarwal has over 23 years of experience in the real estate industry and is the founder of Black Olive Ventures ("BOV"), a real estate valuation and advisory services company in India. Previously Sunil had co-founded and was the CEO of South Asian Real Estate (SARE), a private equity funded real estate development company. He has served at senior positions with Private Equity firm ICICI Ventures Ltd, HSBC Bank, DS Group, Colliers International and Chesterton Meghraj (now JLL India). He holds a degree in Civil Engineering, Masters in Urban Planning (Housing), MBA in Finance & Marketing and an Honorary Doctorate in Real Estate.

Mr. Sandeep Baid

Mr. Baid has more than 20 years of experience in financial services, lending and investments an Advisor at DSP Investment Pvt. Ltd. Previously he was a member of the Founding Team, Managing Director & Head - Credit at Indostar Capital Finance Ltd. He was MD & Head of Debt Capital Markets - Bank of America & DSP Merrill Lynch. He has led lending transactions of more than INR 35,000 cr over last 15 years without any losses or NPAs. He has completed his education from PGDBM - IIM Calcutta.

Gaurav Dalmia

Mr. Gaurav Dalmia serves as Managing Partner & Advisor at Global Technology Investment Group. He serves as Board Member at SAMHI Hotels. He is an Angel Investor

- Founded Landmark Holdings, a real estate investment firm with more than 45 investments.

- Co-founded GTI Capital, a “club” of high net worth investors from USA, to make alternative investments in India.

- Sponsor and Board member of India Value Fund, a $ 3.5 billion Indian private equity fund, focused on control transactions.

- Co-founded Infinity, India's first angel investment fund.

- Co-sponsor of Evolvence India Fund, India's first fund of private equity funds, with capital backing from the Middle East.

Mr. Avadhoot Sarwate

Mr. Avadhoot holds CA, CFA, MBA with 14+ years of experience in corporate finance, investments & Mergers and Acquisitions in Real estate and Infrastructure assets. Heads fund raising, which included raising Term loans, Working capital, Equity, Structured finance at the group level and for the investee real estate projects. Achieved financial closure for 5 affordable housing projects spread across 4 different geographies. Raised more than $ 1 bn in Equity, M&A and Debt for Infrastructure assets.